By Hadia Safeer Choudhry

On June 11, the latest data from the U.S. Bureau of Labor Statistics showed that the Consumer Price Index (CPI) rose 2.4% year-on-year in May, a slight increase from the 2.3% increase in April, but lower than the market expectation of 2.5%. It seems that after the United States imposed tariffs on the world, the CPI did not meet market expectations.

But is this really the case?

Real numbers will deteriorate soon

The impacts of the pandemic-era government spending and monetary policy that helped support the U.S. economy have faded, and that makes the country vulnerable to a downturn in the coming months, according to JPMorgan Chase CEO Jamie Dimon.

“I think there’s a chance real numbers will deteriorate soon,” Dimon said.

Trump’s tariffs have yet to really affect data like monthly inflation and jobs reports, but the economy is prone to a downturn if that changes, Dimon added. It will likely be a few months before the full impact of tariffs on business decisions, hiring and inflation show up.

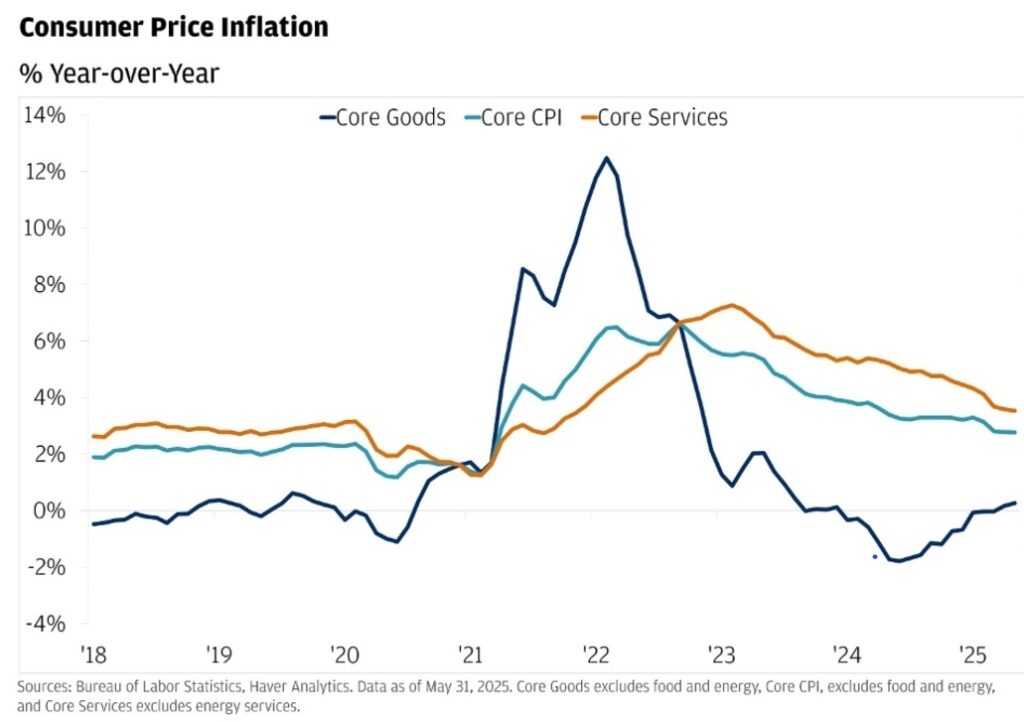

The inflation in the past two months has performed better than expected, but it is not difficult to analyze that considerable potential inflationary pressure is lingering. Inflation reacts slowly to Trump’s comprehensive tariffs because most retailers are selling goods accumulated before the import tariffs take effect, which means that the inventory before the tariff increase may lead to a delay in the transmission of the tariff effect, and the huge uncertainty of the US trade policy may also affect the speed at which companies adjust prices.

Experts pointed out that inflation will pick up in the second half of this year. The data for the next quarter is very likely to show a significant increase, which is in line with Wall Street’s forecasts.

In addition to the consumption of inventory, the fact that the tariff negotiations between Trump and many countries have not yet concluded is also a major factor. Considering the complexity of the tariff negotiations, if no agreement is reached within 90 days, Trump will choose to restore high tariffs. At this time, the inventory will also be exhausted, thus the situation will be very different. Price increases caused by tariffs usually appear two to three months later, so more significant upward price pressure is expected to appear in June and July. Considering the Trump administration’s wavering tariff strategy, as well as the uncertainty of the policy’s timing, form and duration, companies may adopt a wait-and-see pricing strategy, by which may delay the inflation, ultimately leading to a more chaotic and lasting response.

Dollar Disenchantment Deepening

By far, there are still major differences among Fed officials remain deeply divided over the direction of monetary policy and when it might begin cutting interest rates. Chairman Powell holds a more neutral position, believing that the current inflation has eased, providing room for the Fed to “continue to wait and assess the situation.” Rick Rieder, BlackRock’s chief investment officer for global fixed income, believes that if the economy continues to perform weakly, the possibility of a rate cut in September still exists.

Another giant Morgan Stanley warned about the outlook for the U.S. dollar, predicting that it will depreciate significantly in the coming year as the Fed’s interest rate cuts take effect, and the dollar index may plummet by 9%. More than that, the Bloomberg Dollar Spot Index has fallen nearly 10% so far in 2025, the worst start since the index was launched in 2005. Trump’s trade policy has weakened market confidence in U.S. assets and triggered a re-examination of the world’s reliance on the global currency.

A series of regional conflicts such as Russia-Ukraine and Palestine-Israel has caused the global geopolitical risk index to soar, which has also led to a bullish trend for the US dollar in the 2021-2022 period. However, in the past two years, US debt has once again exceeded the upper limit, and the total interest expenditure on US debt in 2024 has exceeded 1 trillion US dollars. In addition, the US government has continuously weaponized the currency and imposed a series of measures such as financial sanctions, which has led to a decline in global investors’ confidence in the US dollar.

Besides, this in turn stimulated the demand for gold. Therefore, it is not difficult to see that many central banks have significantly increased their gold reserves in the first quarter to hedge against the risk of US dollar depreciation and financial market volatility.

The dollar’s depreciation is already reshaping global currency flows, with bullish bets on most Asian currencies rising significantly as uncertainty over a U.S.-China trade deal continues to weigh on the dollar, a Reuters poll showed.

As the world’s main reserve currency, the depreciation of the US dollar may lead to major structural changes in global trade and capital markets. If the depreciation accelerates, it may lead to broader instability. Lower interest rates may boost short-term GDP and slightly stimulate inflation, but if the US dollar depreciates too quickly, it may cause turmoil in global financial markets.

In general, the current domestic economic pressure in the United States lies mainly in controlling inflation. Some analysts estimate that the US economic growth rate in 2025 will be between 1.8% and 2.2%, but whether inflation could be effectively controlled requires much more complicated factors to be considered, which depends on the progress of tariff negotiations and the timing of the Fed’s interest rate cuts. To sum up, it is very likely that annual inflation will rise to 3%-3.5%.

About Author

Ms. Hadia Safeer Choudhry is an international researcher and an independent freelance writer contributing to global discourse.