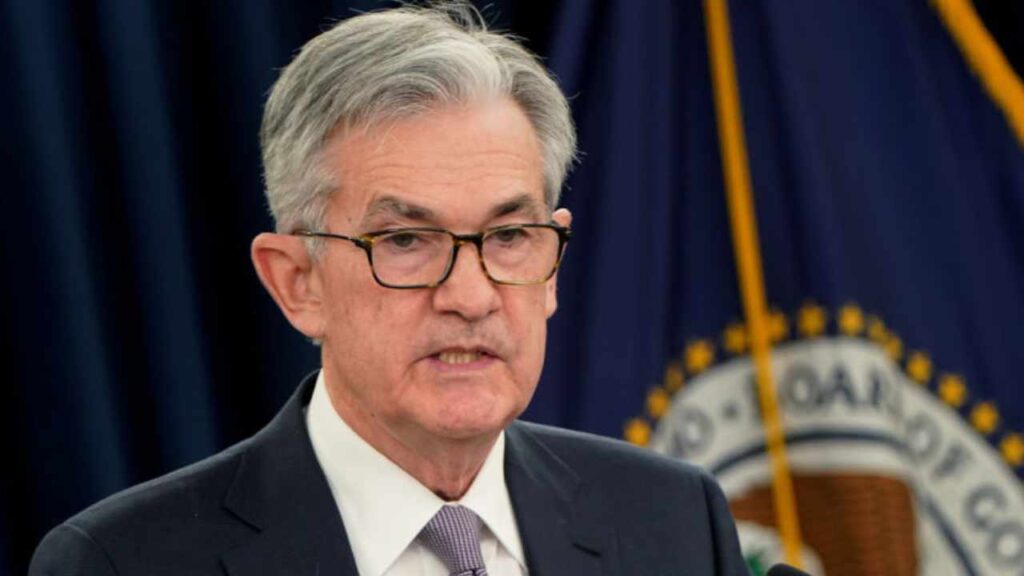

A recent survey conducted by the National Association for Business Economics has highlighted significant concerns among economists regarding potential risks to the U.S. economy, particularly stemming from the Federal Reserve’s handling of interest rates during its ongoing inflation battle. As Federal Reserve Chair Jerome Powell prepares to address the association, 39% of the 32 economists surveyed identified a “monetary policy mistake” as the most considerable downside risk to the economy over the next year. This was in contrast to 23% who pointed to the outcome of the upcoming U.S. presidential election on November 5 and the same percentage who highlighted the intensification of geopolitical conflicts, such as those in Ukraine and the Middle East, as major threats.

The survey’s findings underscore the critical nature of the Fed’s current monetary policies as it aims to balance the dual objectives of reducing inflation—which has shown signs of moderation in recent months—and maintaining a stable job market. Powell is anticipated to elaborate on the Fed’s recent decision to cut its benchmark interest rate by half a percentage point at its meeting in mid-September and discuss further expected reductions in borrowing costs as the year progresses. The Federal Reserve is expected to make another cut during its policy meeting scheduled for November 6-7.

While core inflation has been gradually declining, it remains above the Fed’s target of 2%. Fed Governor Michelle Bowman expressed concerns about focusing too heavily on short-term measurements of inflation, emphasizing that the broader year-over-year perspective provides a more accurate picture of economic stability. The survey indicates that 55% of economists believe it is more likely that the economy will perform worse than expected over the coming year, with monetary policy being the top concern.

The economists project a slowdown in U.S. economic growth to 1.8% in the coming year, down from an estimated 2.6% this year, with the unemployment rate expected to rise to 4.4%. Despite these projections, two-thirds of respondents do not foresee a recession occurring until at least 2026. Such outcomes would likely be viewed favorably by the Fed, suggesting a successful “soft landing” for the economy, with inflation having decreased from a peak of over 7% in 2022 to 2.2% last month.

However, there is considerable disagreement among economists about the appropriate course of monetary policy going forward, with many suggesting that the Fed may already be deviating from the optimal strategy. While a majority indicated that the recent rate cut was timely, only a third believe that the current policy rate is appropriate, with others divided over whether it should be lower or higher.

In addition to concerns about monetary policy, the survey also explored the impact of the upcoming presidential election on economic stability. Responses were mixed regarding which potential election outcomes might pose the greatest risks, with some economists viewing a unified government—whether Democratic or Republican—as both an opportunity and a risk, depending on the implications for policy-making.

As Powell prepares to speak on these issues, the Federal Reserve’s decisions in the coming months will be critical in shaping the economic landscape for the remainder of the year and beyond.