By Hadia Safeer Choudhry

U.S. Treasury yields have continued to fluctuate and rise recently. Goldman Sachs’ latest report predicts that the 30-year Treasury yield may exceed 6%, while the 10-year Treasury yield may exceed 5%.

Entering June, after a brief correction, U.S. Treasuries suffered another bad start with yields on U.S. Treasuries of all maturities rising by 4 to 7 basis points on June 2.

Is Big Beautiful Bill really beautiful?

Analysts generally believe that the rapid rise in U.S. long-term Treasury yields since April and the resulting market shock are, first of all, because the Trump administration’s “reciprocal tariffs” and extreme fiscal austerity policies have led to a surge in domestic inflation expectations; secondly, the Federal Reserve has not relaxed its stance on the path of interest rate cuts, and market expectations for interest rate cuts have continued to weaken; in terms of overseas demand, central banks of many countries have continued to reduce their holdings of U.S. Treasuries, and the dollar’s reserve share has fallen to 55% in the fourth quarter of 2024, a 30-year low.

Worse still, the U.S. fiscal deficit rate in fiscal year 2025 is about 7.0%, as well as the cumulative deficit has increased by 22% year-on-year. The Trump administration is pushing for the implementation of the fiscal and tax bill, focusing on spending cuts. This has undoubtedly further deepened market concerns about the US’s debt repayment ability.

Analysts pointed out that when U.S. Treasury bonds mature, they are basically repaid with new debt. However, if the government debt is too large, it will be bitterly opposed by Congress and the public. At the same time, if interest rates remain high, it will lead to excessive pressure to pay interest, further compressing future fiscal space. In terms of payment pressure, the U.S. government’s net interest expenditure has accounted for 3.1% of GDP last year, which is close to the historical high of 3.2% in the early 1990s. Therefore, the current fiscal situation in the United States is: under the background of high interest rates + high deficits, the pressure to pay interest is high, and the continuous rolling renewal has caused the debt scale to expand too quickly.

Blackrock Weekly Commentary [Photo/ Blackrock]

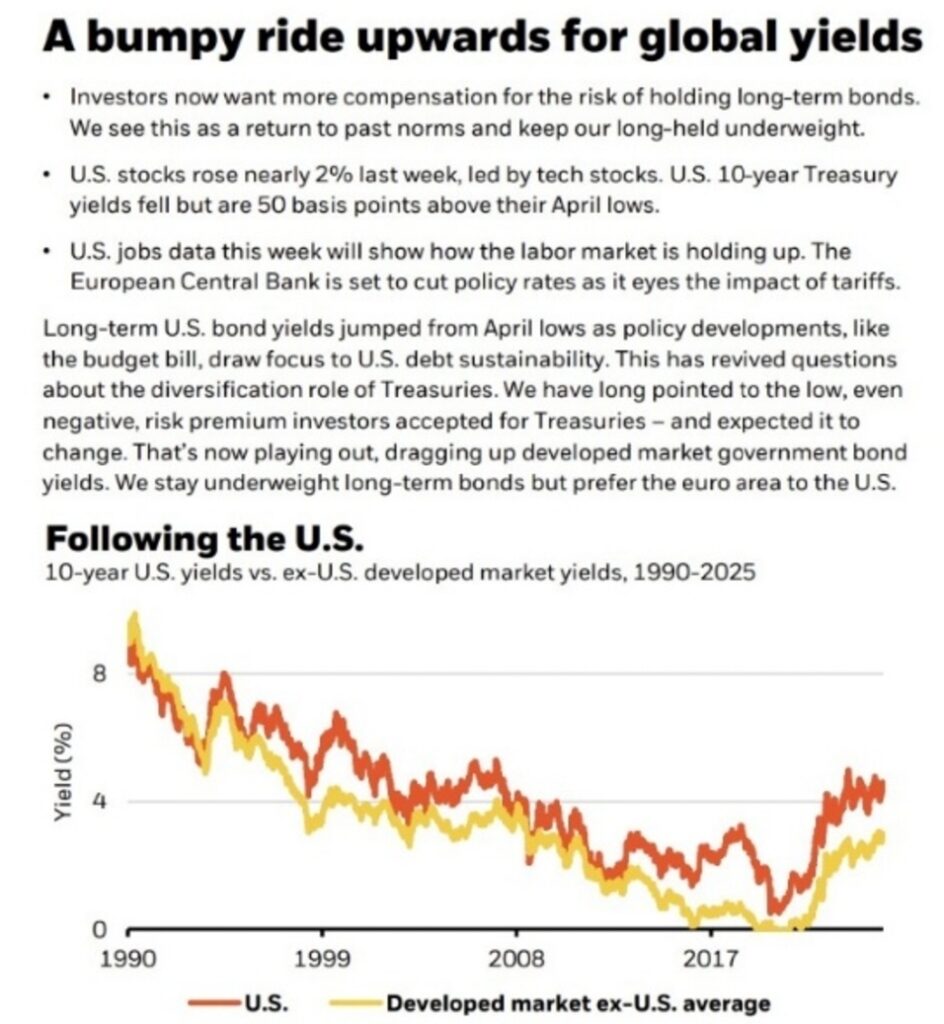

It is worth mentioning that even though the long-term U.S. Treasury yields are close to the cyclical peak level in 2007, the overall U.S. Treasury holdings of large bond investment institutions are still low, and they prefer to hold U.S. Treasury bonds with shorter maturities, such as 5-year and below. BlackRock Investment Institute said in its latest weekly report, “We stay underweight long-term bonds but prefer the euro area to the U.S.”

Blackrock is closely watching whether Congress will pass

Beautiful Bill [Photo/ Blackrock]

Against the backdrop of persistent fiscal deficits and stubborn high inflation, the agency also said it is closely watching whether Congress will eventually pass Trump’s Big Beautiful Bill. Currently, the U.S. House of Representatives has passed the bill and will now wait for Senate approval. It is estimated that the plan could push the U.S. debt up by another 4 trillion US dollars, which is likely to further increase the U.S. deficit and have a negative impact on foreign investors. Elon Musk slammed this bill, calling it a “disgusting abomination” just days after his official White House send-off as head of the Department of Government Efficiency.

Debt default: on the warning track

Some analysts estimate that considering the impact of tariffs and this bill, the US fiscal deficit in fiscal year 2026 is expected to reach 2.2 trillion US dollars, exceeding market expectations. In the short term, the US Treasury still has room to maneuver, but in the medium and long term, this will further aggravate the negative cycle of fiscal burden, or become the source of continued volatility of US dollar assets, and the US government may be unable to repay its debts in July or August. “Right now, we are at a decision-making point and very close to a recession,” Bridgewater founder Ray Dalio said, not long ago, “And I’m worried about something worse than a recession if this isn’t handled well.” The hedge fund billionaire emphasized he’s more concerned about trade disruptions, mounting U.S. debt, and emerging world powers bringing down the international economic and geopolitical structure that has been in place since the end of World War II.

A latest report pointed out that the probability of the United States falling into a recession in 2025 is more than 50%. Once a large-scale sell-off of US bonds occurs, the US bond prices will continue to plummet, the US bond derivatives market will collapse, and the global financial market will be violently shaken. Many institutions predict that there will be a “market crash similar to that in 2008.”

Currently, the US government’s statutory debt ceiling is 36.1 trillion US dollars, which has been reached at the beginning of the year. At present, U.S. Treasury bonds can only be renewed in stock but cannot achieve net new issuance, which limits the scale of Treasury bond. The Congress needs to pass a bill to raise or suspend the debt ceiling before August, otherwise the government will be forced to shut down. Once the debt ceiling is raised or suspended, the scale of U.S. Treasury bond issuance will increase significantly, and subsequent maturity pressure will also increase. However, US Treasury Secretary Scott Bessent said the US “is never going to default” as the deadline for increasing the federal debt ceiling gets closer.

“That is never going to happen,” Bessent said in an interview for CBS’s Face the Nation. “We are on the warning track and we will never hit the wall.” But since the beginning of the year, the US Treasury has been relying on “unconventional means” to avoid government debt default. In the meantime, Bessent declined to specify an “X date”-the point at which the Treasury runs out of cash and special accounting measures that allow it to stay within the debt ceiling and still make good on federal obligations on time. Last month, Bessent told lawmakers that the US was likely to exhaust its borrowing authority by August if the debt ceiling isn’t raised or suspended by then.

If the erratic tariff policy of Trump administration sparks global outrage, leading major countries to jointly sell off U.S. debt as a countermeasure, with adopting the most aggressive selling speed, it could have an unpredictable and huge impact on the U.S. debt market, as well as even the global financial market.

About Author:

Ms. Hadia Safeer Choudhry is an international researcher and an independent freelance writer contributing to global discourse.